Contents:

After you fill out the registration form and fund your account, you’ll be able to trade on Forex. Novice or introductory traders can use micro lots, a contract for 1,000 units of a base currency, to minimize or finetune their position size. One of the best forex tools that traders can use is forex signals. These help semi-automate forex currency trading by providing well-researched trade opportunities that only require the trader to place the trade. Usually, these signals are sent in the form of a text message or email directly to the trader’s smartphone.

Instead, all of eToro’s fees are incorpoforex trading explainedd into the spread, quoted on each currency. EToro ensures that their spreads are as low as possible, with spreads on EUR/USD and USD/JPY typically being only one pip. EToro is the favoured broker of over 20 million people worldwide, thanks to its extensive regulation and low-cost fee structure.

Example of a Forex Trade

If you’d like, you can complete this step through eToro’s app – one of the best trading apps available to FX traders. It would be best if you always used a stop loss when placing a forex trade. The forex market is inherently volatile, so operating without a stop loss will always leave you open to blowing your account. Although there are many different trading strategies out there, the three mentioned below are some of the most popular amongst FX traders. The forex market opens at 5pm EST on Sunday afternoons and closes at 4pm EST on Friday afternoons. Between these times, the forex market is open to all participants across the world through different ‘sessions’, such as the London, New York, and Asian sessions.

For example, an investor might buy the euro versus the U.S. dollar (EUR/USD), with the hope that the exchange rate will rise. Assuming the rate moved favorably, the trader would unwind the position a few hours later by selling the same amount of EUR/USD back to the broker using the bid price. The difference between the buy and sell exchange rates would represent the gain on the trade. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

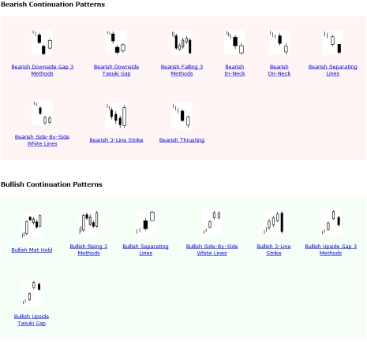

Some of the most popular forex trading styles are scalping, day trading, swing trading and position trading. You might choose a different style depending on whether you have a short- or long-term outlook. Traders speculate on forex pairs to profit from one currency strengthening or weakening against another. When the price of a pair is rising, it means that the base is strengthening against the quote and when it’s falling, the base is weakening against the quote. As forex is traded on exchanges across the globe, from Tokyo to London to New York, you can take a position 24 hours a day throughout the trading week.

To help you decide which broker to partner with, we’ve conducted all the research and testing and narrowed the options down to our top three brokers for forex traders. This strategy requires great discipline, as there’s a high likelihood that the trade will go against you at some point during the holding period. However, as these trades are designed to be held for a more extended period, swing traders mustn’t micro-manage the position once it has been opened.

What are pips in forex trading?

When you sign up for a new live account for trading, you get $50.. Another great feature of Capital.com is the extensive library of educational material that they offer. Users can read various guides and articles and even use the Capital.com TV feature, which analyses current market events.

Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. This leverage is great if a trader makes a winning bet because it can magnify profits. However, it can also magnify losses, even exceeding the initial amount borrowed.

Forex Trading Hours

Large differences in interest rates can result in significant credits or debits each day, which can greatly enhance or erode profits of the trade. Most speculators don’t hold futures contracts until expiration, as that would require they deliver/settle the currency the contract represents. Instead, speculators buy and sell the contracts prior to expiration, realizing their profits or losses on their transactions. The euro is the most actively traded counter currency, followed by the Japanese yen, British pound, and Swiss franc.

- https://g-markets.net/wp-content/uploads/2021/09/image-5rvp3BCShLEaFwt6.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-NCdZqBHOcM9pQD2s.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/male-hand-with-golden-bitcoin-coins-min-min.jpg

- https://g-markets.net/wp-content/themes/barcelona/assets/images/placeholders/barcelona-sm-pthumb.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-sSNfW7vYJ1DcITtE.jpeg

If imported French cheese suddenly costs more at the grocery, it may well mean that euros have increased in value against the U.S. dollar in forex trading. The forex market is traded 24 hours a day, five and a half days a week—starting each day in Australia and ending in New York. The broad time horizon and coverage offer traders opportunities to make profits or cover losses. The major forex market centers are Frankfurt, Hong Kong, London, New York, Paris, Singapore, Sydney, Tokyo, and Zurich. With spread betting you stake a certain amount per pip movement in the price of the forex pair. So for instance you might buy £10 per pip on USD/JPY, to make £10 for every pip the US dollar rises against the Japanese yen.

One great way to learn is to take a course that will provide a comprehensive overview of the market and how it works. You could also utilise a demo account with a reputable broker to gain risk-free experience in the market. One of our top tips for forex traders is to remove emotion from your trading. Beginner traders typically get emotional and make wrong decisions, leading to losses. Managing your risk is one of the critical components of becoming a profitable trader.

Forex Trading For Non-Experts – Forbes Advisor UK – Forbes

Forex Trading For Non-Experts – Forbes Advisor UK.

Posted: Tue, 12 Apr 2022 07:00:00 GMT [source]

If the Eurozone has an interest rate of 4% and the U.S. has an interest rate of 3%, the trader owns the higher interest rate currency in this example. If the EUR interest rate was lower than the USD rate, the trader would be debited at rollover. The largest foreign exchange markets are located in major global financial centers including London, New York, Singapore, Tokyo, Frankfurt, Hong Kong, and Sydney. Like any other market, currency prices are set by the supply and demand of sellers and buyers.

Whenever you view a financial market, you’ll see two prices listed. The price on the left is thebidand the price on the right is theask. As we covered in the Introduction to financial marketscourse, the number of buyers versus the number of sellers in a market at a given time will directly impact its price. Forex trading is the act of speculating on the movement of exchange prices by buying one currency while simultaneously selling another. Understanding how your broker and trading style affect the lot you use is one of the first things that you should learn in trading.

Forex Trading: What is Forex?

The large daily volume of the Forex market provides endless trade opportunities and the ability for traders to diversify into global currency markets. Let’s see now how to fundamentally analyze the currency markets for dummies. Fundamental analysis involves the measurement of the fair value of a currency.

Futures contracts are traded on an exchange for set values of currency and with set expiry dates. Forex is traded by what’s known as a lot, or a standardized unit of currency. The typical lot size is 100,000 units of currency, though there are micro and mini lots available for trading, too. A forward trade is any trade that settles further in the future than a spot transaction.

To determine whether an exchange rate will rise or fall, Forex traders mostly rely on two analytical disciplines – technical analysis and fundamental analysis. Technical analysis is based on price chart analysis and provides exact entry and exit points, while fundamental analysis is vaguer and involves the measurement of a currency’s fair price. It’s usually easier to learn technical analysis for beginners, as fundamentals include certain economic theories to be fully understood. Currencies can’t be traded on their own, but they need to be paired with another currency to form a currency pair. The exchange rate of a currency pair reflects the price of the first currency expressed in terms of the second currency. For example, if the euro vs. US dollar pair trades at 1.30, this means that one euro buys 1.30 US dollars, or it takes 1.30 US dollars to buy one Euro.

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-KGbpfjN6MCw5vdqR.jpeg

Our advice is to research this topic thoroughly to ensure you know if you’ll need to pay tax and how much. Pips are simply a unit of measurement that are used to measure changes in a currency’s value. Most currencies are quoted to four decimal places, and a pip refers to the last of the four digits. Next, enter a valid email address and choose a password for your account.

Again, US https://g-markets.net/ accounts cannot do this, but traders in the rest of the work can. You’ll have to make your decisions on which lot size is right for you, but knowing the right lot size before your first trade will get you started on the right foot. When a broker only offers mini or micro lots, then you have to round up or round down.

Finally, exotics are currency pairs that are rarely traded and have pretty low liquidity – meaning these are best saved for advanced traders. A currency pair is a price quote of the exchange rate for two different currencies traded in FX markets. The foreign exchange is the market where currency pairs are traded. Forex, also known as foreign exchange or FX trading, is the conversion of one currency into another. It is one of the most actively traded markets in the world, with an average daily trading volume of $5 trillion. Take a closer look at everything you’ll need to know about forex, including what it is, how you trade it and how leverage in forex works.